Five ways that Reg CF makes it easier to raise capital

If it's not already easy for you to raise capital, Regulation Crowdfunding won't make it easy. But it can make it easier.

There are two reasons to run a Regulation Crowdfunding (Reg CF) raise.

Firstly, because you think it’s cool to let your customers and community invest. You might not even need the money — VCs are lining up to throw money at you. But you believe (as I do) that if your customers invest in your company, they will spend more money with you, be more passionate brand ambassadors, and help you win. Plus, why not let your earliest supporters benefit from the upside you create, as well as some VCs. Mercury is a good example of this first use case for community rounds. Or Beehiiv, Replit, Fathom — the list is growing with every passing week.

But the second, and far more common, use case for community rounds is to raise more money, more quickly. Especially in this fundraising environment, unless your domain name ends in .ai, it’s much harder to raise capital than it used to be. Perhaps you have raised some capital from institutional or angel investors. But things are moving too slowly. It’s a grind. Investors are prevaricating, wait-and-seeing. As they are wont to do.

In situations like this, Wefunder can help founders raise more capital, more quickly. In these five ways:

Unaccredited AND Accredited Investors

Public Promotion

Wefunder’s 1M+ Audience

Ability To Hoover Up Smaller Checks

Increased Luck Surface Area

1. Unaccredited AND Accredited Investors

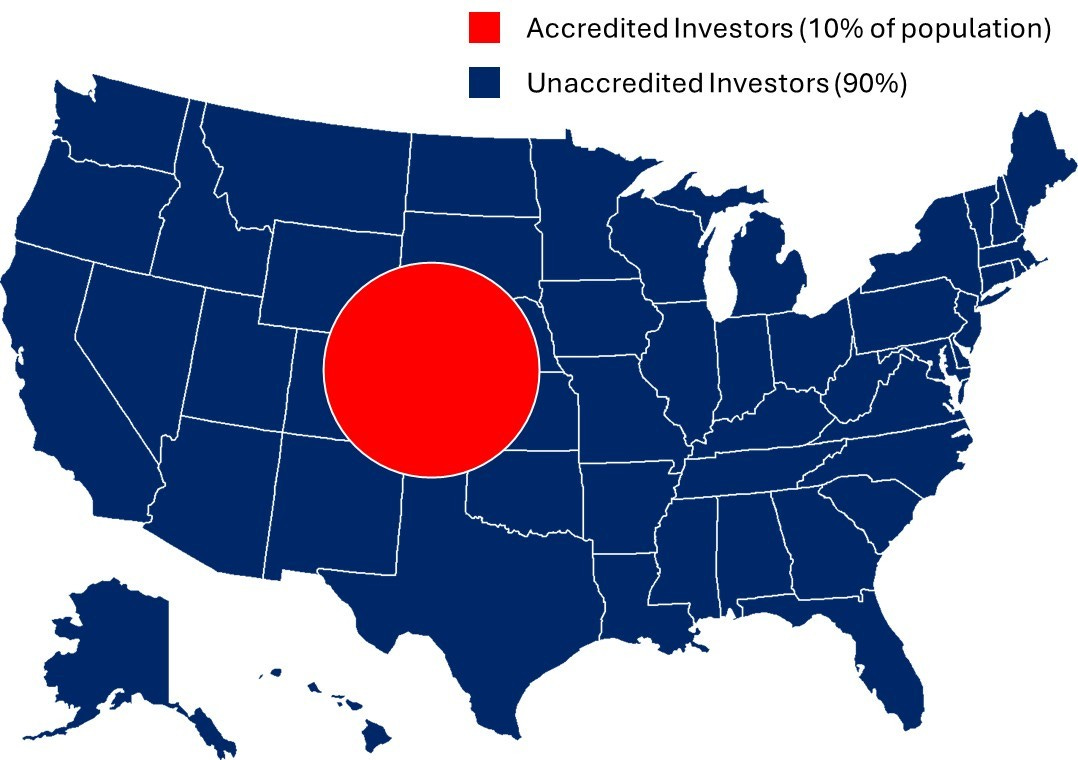

You can still raise from accredited investors via Reg CF. In fact, 50% of Wefunder’s investment volume comes from accredited investors. But with Reg CF you can now also raise from unaccredited investors.

I have tons of friends and people in my network who, if I launched a community round on Wefunder, would love to invest a small amount. But who are not accredited. At Wefunder, we also think it’s a “good thing” that anyone can invest in startups they love, not just rich people. But forget the principle of it. From the perspective of this blog post — and the aim of raising more capital, more quickly — if you can pitch your investment opportunity to an additional 90% of the population, that can help accelerate your fundraising.

2. Public Promotion

I think it’s bizarrely anachronistic that, in Silicon Valley, in 2025, most startups raise capital behind closed doors, through “private solicitation” of investors. I suspect that system is happily perpetuated by the VC gatekeepers — it gives them more leverage in the power dynamic.

But with Reg CF, you can publicly promote the investment opportunity. So Substack can send an email blast to their millions of users and raise $5M+ in 24 hours. The Oakland Roots and Soul can announce their raise on social media. Liz Clayborne can go on a radio show. Rich White can go viral on LinkedIn (twice). Tyler Denk can share on Twitter.

If you’re world class at marketing, you can now use that superpower to raise capital. And due to point (1) above, everyone who sees your raise can invest, not just accredited investors.

3. Wefunder’s 1M+ Audience

The average company raises 50% of their total amount raised on Wefunder from our existing investor base. So whatever you can bring to the party, on average, we will double it.

And what’s really cool for me to see — what I would assess to be the stronger companies tend to pull in an even higher percentage from existing Wefunder investors. For example, Pirouette (a Y Combinator-backed startup founded by three rocket scientists) pulled in 80% of the capital they raised from existing Wefunder investors. With only 20% coming from first-time investors. YC companies historically have pulled in around 70% from the Wefunder investor base.

Wefunder’s user base is now well over a million people. And of those, around 400,000 have made at least one investment on the platform. Of those, 40,000 are accredited.

The first $50K of capital is all on you to recruit. But when you pass that threshold, you have the option to go public on Wefunder’s Explore page whenever you want to. We will send emails about your startup to our investor base, as well as highlight you on the website (around 250K monthly unique site visitors).

And it’s not just the quantity too. There are some awesome founders, investors and even celebrities in the Wefunder investor base. Multiple founders have now reached out to me in excitement because Whoopi Goldberg just invested in their community round!

4. Ability To Hoover Up Smaller Checks

I’m an accredited investor. $300K household income. Thank you Sugar Mama Wife. But if my very very good college friend came to me and said “Hey bro, want to invest $25K in my super risky early stage startup? Your money will be locked up for 10 years, and it will probably go to zero”, I would say “Hmm, sorry Kajan. I think you’re really smart and all. And the startup sounds cool. But I have three kids who plan on going to college in the next few years. I can’t quite stretch to that.”

But if Kajan sent me his Wefunder page? Sure, here’s $2,500.

I have heard this feedback from a lot of founders down the years — Wefunder was a valuable tool for hoovering up a bunch of smaller checks from investors who might not have been able to stretch to a larger investment in a Reg D round. And of course, we roll them all up into one SPV on your cap table.

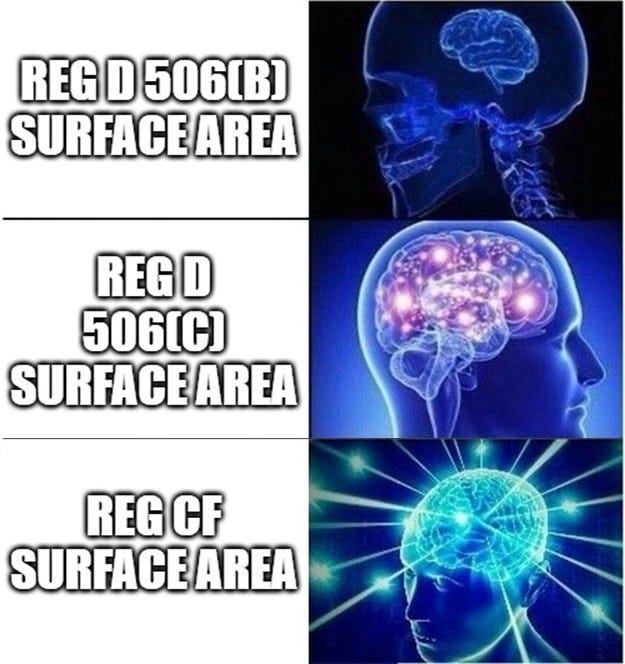

5. Increased Luck Surface Area

The other day, a founder told me a story of how an investor saw his Wefunder raise in a local newspaper article, and then invested $10K, without even talking to the founder. Naturally, the founder reached out to the investor, and it turns out this guy is a successful, exited founder, and the head of the city’s chamber of commerce. After they built a relationship, this investor is now looking to invest six figures personally, as well as recruiting a number of other local business leaders to invest in the startup as well.

On this podcast with Micha Mikailian, the founder of Geoship, he cites a similar example. One of his investors, who invested just $100, was so effusive in his enthusiasm for Geoship, that he impressed a high net worth individual, who then connected with Micha, and invested a six-figure check.

Cxffeeblack raised $348K on Wefunder from 568 investors. But then they also connected to an additional $500K that they closed outside of Wefunder. The founder Bartholomew tells me that this $500K was caused by their Wefunder community round.

So many examples like these. When you can publicly promote the offering, when you can get in front of a million Wefunder users, and when you can recruit thousands of investors to your cause, it’s a powerful increase in your luck surface area.

When you add all these five ideas together, you can see how it starts to compound, and make raising capital a little easier for founders that need to push the gas pedal.

And of course, as with all fundraising, momentum is crucial. If things are moving slowly, investors can afford to wait. Investors respond to scarcity, urgency, “pressure” — Reg CF helps you fight the inertia, and get things moving.

Startups are hard. I personally think that almost all founders would benefit from recruiting an army of supporters and champions to help them succeed and grow. Your army of Reg CF investors can help you with marketing a product launch, giving product feedback, hiring, or whatever else you would like their help with. And both Wefunder and Arrived (and many others) have found that when their customers invest, they become much more loyal and active customers!

That is, there are many other reasons to run a community round via Reg CF. But raising more capital, more quickly is definitely a big one.